For example, you can probably deposit a variety of check types such as cashier’s, traveler’s, money orders, and more. Also, make sure you know what your maximum daily amount is. If you have more to deposit than you’re allowed, you may have to actually go into your bank or space your deposits out over a few days. Paper checks are less popular than they were in the past. But when you get one, you will want to deposit the money. Here's what you need to know to deposit a check at a branch, at an ATM and on.

Such deposits are considered large deposits. Checks that are re-deposited may be held for a reasonable period of time; however, if a customer returns the check due to a missing endorsement. Once you deposit your check, the bank will make that money available in your account once it clears, which usually takes a day or two. If you put it into a checking account, you can then draw on it by using your debit card (or you can withdraw it from an ATM, should you turn out to need actual cash). Deposit checks while on the go With GoBank, depositing a check is as easy as snapping a few pics on your smartphone! Forget about branches, check cashers, and ATMs. No more business hours to think about. Skip the trip and the long teller lines. Avoid any check-cashing fees.

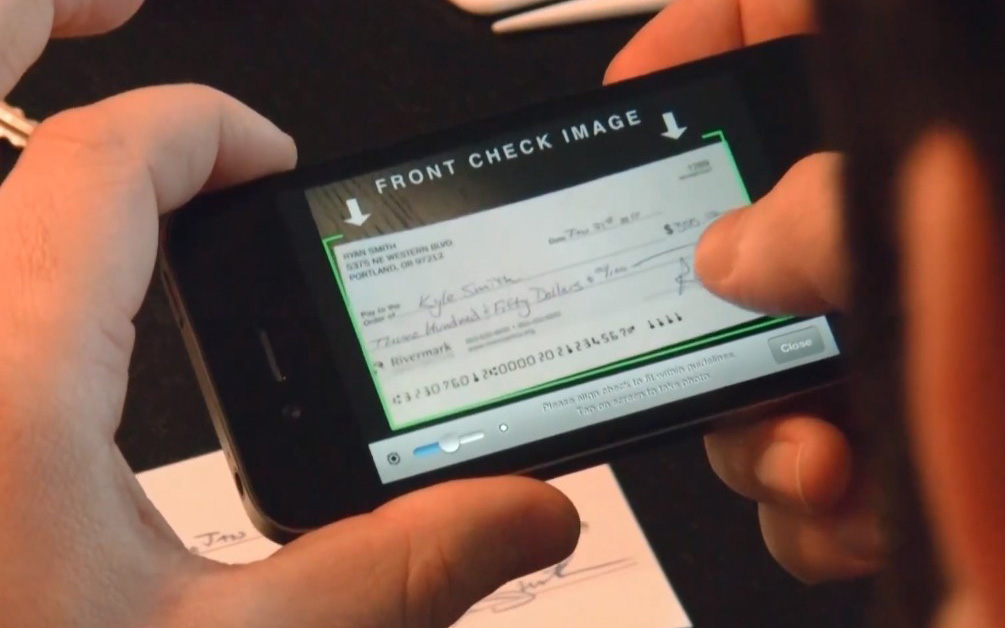

How mobile deposit works

Explore these simple steps to deposit checks in minutes.

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account’s remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”).

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that’s well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device’s screen.

1. Make sure your deposit information is correct, then select Deposit.

2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit.

Best megaways stocks. 3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Still have questions?

Quick Help

Call Us

Find a Location

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

LRC-0620

How it works:

Process all types of U.S. checks, drawn on any bank or credit union that is a Federal Reserve member, including personal checks, business checks, government checks and warrants, money orders and traveler's checks over the Internet. Using check truncation, the paper checks never leave your office and, in fact, should be destroyed after the successful deposit of funds into your bank.

Deposit Check Cash App

The use of electronic check conversion - also known as Check 21, Accounts Receivable Check (ARC), Point of Purchase (POP), or Back Office Conversion (BOC) in banking terms - is among the fastest growing types of ACH applications due to its enormous benefits. Games like mr president. Using our proprietary Internet-based Back office conversion 'Remote Deposit Capture' software and check scanning reader, you can scan conventional paper checks and transform them into an electronic check deposit. The software also stores the check data and check images in a database for future research and retrieval, re-submission of NSF checks and more.

Deposit Check Online

You accept many checks each month from customers. Currently, you would have to look up each customer account, apply the payment to the account, stamp the check for deposit, create a deposit slip, drive to the bank, stand in a long line and make the deposit. On top of this, your bank will typically charge an 'item deposit fee' for every check you deposit. Too time consuming and too expensive!